Canada – Renewable Energy

Canada – Renewable Energy

Take advantage of our market research to plan your expansion into the Canada Renewable Energy market. This guide includes information on:

- Current market needs and trends

- The competitive landscape,

- Best prospects for U.S. exporters,

- Market entry strategies,

- The Regulatory Environment,

- Technical barriers to trade, and more.

Executive Summary

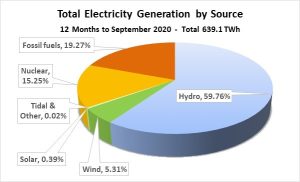

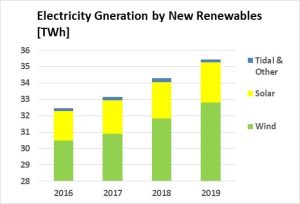

Canada is one of the world’s leading countries in using clean, renewable energy. Approximately 65% of the total electricity generation in 2019 was sourced from hydro, wind, solar, and other sources such as biomass, geothermal, and marine/tidal wave energy. Hydropower is historically Canada’s main source of energy, providing around 60% of the electricity. New renewable sources – wind, solar, tidal waves, and others – have the highest growth rate and are projected to reach 12% of total power generation by 2035, according to the Canada Energy Regulator (CER).

(Source: Statistics Canada)

Total electricity generation has been relatively stable in recent years, around 640 TWh annually, as steady, slow increases in industrial, commercial, and residential electricity needs have been offset by improved efficiency solutions. A slight annual increase is expected for the coming years. Canada’s total installed electricity generation capacity from all sources was approximately 135 GW in 2017 and is projected to reach 170 GW by 2035.

Canadian provinces and territories have the authority over their own electrical power systems, and all are pursuing renewable power generation sources. Quebec has 98% of its electricity generation from hydropower, while British Columbia, Manitoba, Newfoundland and Labrador, Prince Edward Island, and Yukon systems rely on between 89% to 95% hydro.

The renewable energy sector needs, the maintenance and upgrade of the existing capacities, and for further new capacities, are estimated to drive one-third of Canada’s $20 billion USD total annual imports for the electrical power sector. Around 45% of all Canadian imports for the electrical power sector are from the U.S. providing significant opportunities for U.S. exporters.

Current Market Needs

The main market drivers at the macro level are primarily the need for ongoing maintenance and the upgrade of the existing power generation capacities. In addition, a slow increase of the total capacity combined with policies and planning for further shifting the generation towards renewable sources supported by all government levels from federal to provincial and local levels are also driving the market.

Hydro

Canada has a total installed capacity of over 80,846 MW in over 450 hydroelectric power stations and 200 small hydro plants (less than 10 MW), almost entirely in water accumulation and down-the-river generation plants. The remaining technical potential that Canada has in building hydropower generation is more than the current installed capacity. New projects of large capacity are already in development or in planning capacities from 500 MW to over 2,000 MW, including:

- Lower Churchill Project on Muskrat Falls and Gull Island in Labrador,

- Site C dam on the Peace River in British Columbia,

- Keeyask on the Nelson River, Manitoba.

Many small hydro plants are also in development. The segment will require hydraulic turbines and electrical generators across the entire range of electrical ancillary equipment and materials used in hydropower stations.

Wind

Wind is Canada’s second-largest source of renewable energy. The installed wind energy capacity in Canada was 114 MW in 2009. Strong provincial policies and support like the “Fed-in-Tarif” program introduced by Ontario in 2009, led to a steady dynamic growth on an average annual rate of 16% for the last 10 years. The total installed capacity reached 13,413 MW at the end of 2019. There were over 300 operational wind farms in Canada with a total of over 6,770 wind turbines. 37 wind farms have at least 100 MW capacity, including three with over 300 MW capacity each. Almost all are on shore and grid-connected wind farms. The leading provinces for wind power generation are Ontario (5,436 MW), Québec (3,882 MW), and Alberta (1,685 MW).

The market is expected to continue to grow in 2020 – 2025 by an average annual rate of 5% (Source: CanWEA – Canadian Wind Energy Association). For the forecasted annual growth, the market will need all types of equipment and components from wind turbines and wind-driven electrical generators, to all ancillary components and materials.

Solar

The total solar photovoltaic (PV) power installed capacity for electricity generation was approximately 3,700 MW in over 44,000 installations by the end of 2019. Note that all installed power capacities are in direct current (DC). That is combined with 2,600 MW in centralized installations (feeding only directly to the grid) and 1,100 MW of distribution installations which also consume for individual needs. The majority are connected to the low voltage grids and only about 15% to high voltage grids. For off-grid installations, there is no available data. PV generation is located mainly in Ontario with about 3,000 MW, and the rest in all other provinces, each having under 25 MW, except British Columbia and Alberta.

According to the former National Energy Board, recently renamed Canada Energy Regulator, Canada’s future renewable energy capacity is expected to grow with wind capacity doubling and solar capacity more than tripling by 2040 (Source: CanSIA – Canadian Solar Industries Association). For the forecast increased capacity, the market will need all types of components from PV cells/ panels and inverters to all ancillary operational components and materials for grid or local distribution connection. Similar needs are also for the maintenance of the existing installations.

Energy Storage and Combined Projects

Energy storage projects were initiated in Canada for the past several years and there are already local significant players in this segment, developing various technologies from battery storage to dynamic (flywheel) solutions. An important trend in discussion is between the wind, solar and storage industries in developing combined projects.

Other energy sources

This market segment needs a variety of specialized equipment and ancillary component and materials.

- Tidal Wave Energy: A longtime initiative. Canada has a research project for electricity generation from tidal waves in the Bay of Fundy, Nova Scotia. At present, the project is developed by a not-for-profit consortium led by the provincial government, Fundy Ocean Research Center for Energy (FORCE), which determined that approximately 2,500 MW may be extracted from the 8,000MW of kinetic resource of the Bay of Fundy. The project is budgeted at about $40 million. The federal government provided a grant covering roughly half of the budget.

- Geothermal Energy: Only in the initial phase. In Canada, there are 18 projects in development, mainly at the research stage. A detailed listing is available from the industry association.

- Biogas and Renewable Natural Gas (RNG): Operational and initiate projects in Canada have a total capacity of 196 MW, of which approximately 50% are used for electricity generation and the rest mainly for combined electricity and heat (co-generation) and heat only.

- Biomass: Produced in 47 facilities located in Canada in all provinces coast to coast. 2 new plants are in construction and 6 others are in planning.

The Competitive Landscape

The Canadian market is highly competitive and U.S. exporters of all types and magnitude should expect fierce competition from a large presence of local and foreign competitor companies.

On primary equipment for renewable energy power generation, such as turbines (hydro or wind), electrical generators, solar cells, and panels, the competition is mainly from the major global manufacturers of the respective equipment. Most of them are present in Canada through subsidiaries or representation offices. For example, notable companies with Canadian subsidiaries include Andritz (hydro turbines); Siemens, Enercon, Senvion SE, Goldwind, and Sinovel Wind (wind turbines); ABB, Siemens (electric generators); Samsung (PV cells/panels).

For most other ancillary equipment, components, and materials, there are also strong local manufacturers and well-known foreign manufacturers present with their own subsidiaries, representation offices, and local distribution partners. Large global manufacturers’ subsidiaries may not necessarily be manufactured locally in Canada, but they secure solid technical support through their local subsidiaries or partner companies.

Best Prospects for U.S. Exporters

Canada is one of the top renewable energy markets for U.S. companies. Significant opportunities are driven by existing assets and plans for further development. Specifically, 60-70% of power generation facilities are in progress to be replaced or upgraded during the next 10-15 years. The 2019 Federal Government Budget indicates approximately $14.8 billion USD in funding for infrastructure projects, including those that reduce greenhouse gas emissions, deliver clean air and safe water systems, and promote renewable power. Examples include $22.3 million USD for the Clean Wind Power project in Northwest Territories and $22.2 million USD for the Renewable Tidal Energy project in Nova Scotia.

The 2020 budget was delayed due to the COVID-19 pandemic. The following renewable energy product groups recorded significant volume or increases in 2019 and their respective magnitude indicates opportunities for U.S. exporters. For specific HS product groups, the value of total annual Canadian import is listed in parentheses:

- Hydraulic turbines, water wheels, and regulators therefor ($52 million USD)

- Electric generating sets – wind-powered ($247 million USD)

- Pumps for Liquids, Liquid Elevators

- Electrical Transformers, Static Converters, and Inductors

- Wind turbines, tower sections, rotor blades, casting and forgings, and transformers

- Smart Grid connection and energy monitoring equipment and software applications

- Engineering, construction, and logistics services

The global pandemic impact:

The impact is affecting many sectors of the economy, especially manufacturing. Consumer sector demand remains stable with a possible slight increase. The total demand for electricity for the 12 months prior to September 2020, shows a very slight decrease of less than 0.3%. The regulatory bodies at the federal and provincial levels are committed to maintaining the overall system of power generation, transmission, and distribution operational at full capacity. But maintenance and upgrade activities may be impacted. The total imports year to date October 2020 are already showing over 10% decrease in most product groups. Even with the severe decrease, the market magnitude has many opportunities to rebound, with expectations for increased opportunities in the next period.

Market Entry Strategies

Market entry should consider first securing compliance with the required regulatory certifications, starting with the safety requirements applicable to electrical products, high-pressure products, and elevating devices. Regulatory and enforcement authority is at the level of each provincial government.

Electrical products must have certifications to meet Canadian applicable standards. The most widely used Canadian certification agency and mark is CSA, but other well know certification marks are also accepted as long as they specifically mention that the product complies also with the applicable Canadian standards. Each provincial electrical safety authority lists the acceptable certification marks.

Selling in the Canadian market may be based on various strategies depending on the product and business-specific type and objectives, either direct to end users or through manufacturers’ reps, agents, and distribution channels for large volumes of relatively standardized products. U.S. exporters of such big volume products may also use a specific possibility of the Canadian Non-Resident Importer program by which they can register in Canada as an importer without a physical presence, neither office nor personnel, in Canada.

The Regulatory Environment

Canada Energy Regulator (CER) is the federal government agency overseeing the energy sector. In the electricity sector, however, CER is regulating only the international aspects, primarily the import and export of electricity and related necessary licenses. The regulatory environment of electricity generation, transportation, and distribution is centered at the provincial government level, which has full authority over local electrical system regulations, policies, and enforcement. The customs clearance formalities for the importation of products in Canada are governed by the USMCA trade agreement by which most products of origin from these countries have zero custom duty.

Technical Barriers to Trade

There are no identified technical trade barriers for U.S. products in accessing the Canadian market. For assistance with non-tariff barriers related to trade agreement non-compliance, such as standards and technical regulations-related barriers (i.e., technical barriers to trade), import licensing requirements, and government procurement and investment issues, we suggest contacting the U.S. Department of Commerce: see contact coordinates and process at above-mentioned link Customs, Regulations & Standards

Source: https://www.trade.gov/energy-resource-guide-canada-renewable-energy